Preface: I have 0 background in finance or business.

A hedge fund called Melvin Capital (and likely others were involved) thought that Gamestop was outdated. Indeed, their earnings reports were dismal, and that coupled with the coronavirus pandemic depressing businesses all around, they decided to short the stock. Shorting means they borrow a stock to sell to someone else at a higher price, and are required to return the stock on a specified date. To obtain that stock on that certain date, they would have to buy it at market price. So logically, one would only short a stock that one felt would relatively certainly decrease, to make money off of the deal.

Meanwhile in 2019, a lone guy (u/DeepFuckingValue) who rents a house with his mother in a suburb sees value in Gamestop, does his research, and postulates that the brand will eventually turn around. He invests a cumulative amount of 54k over the ~14 month period, and periodically posts his stock holdings on an online forum known as Reddit, in a group known as wallstreetbets. This group is mostly satire, finding humor in both people’s gains and losses–a mix of those who understand the stock market and things like Greeks, and people like me who just get a kick out of the memes. Somehow, though, someone saw the shorts, and realized that the greedy hedge funds OVER shorted the stock, meaning they borrowed more shares than exist. Rather than keeping this information to themselves, they posted it on reddit, out in the open for anyone and everyone to see.

The name Gamestop came up not just online, but also from my brother, who I consider the more technologically adept. He had been getting into trading and options using the app Robinhood, which made it very easy for the average person to trade. Not only that, Gamestop was a part of my youth. Being a millennial means different things for different people, but for me it was going to CompUSA with my dad, eagerly waiting to play Zelda: Ocarina of Time in the store until I could finally get the N64 game for Christmas. It was being a geek, not quite fitting in everywhere but going to Gamestop knowing that I’m at least not as nerdy as some people. It was pokemon cards and Oregon Trail, and sentimental memories. I had no idea who Ryan Cohen was until two weeks ago. All I knew was some other people liked the stock, and I decided Gamestop probably would be able to weather out this pandemic and eventually go up, and it was so cheap anyway, why not get a few shares?

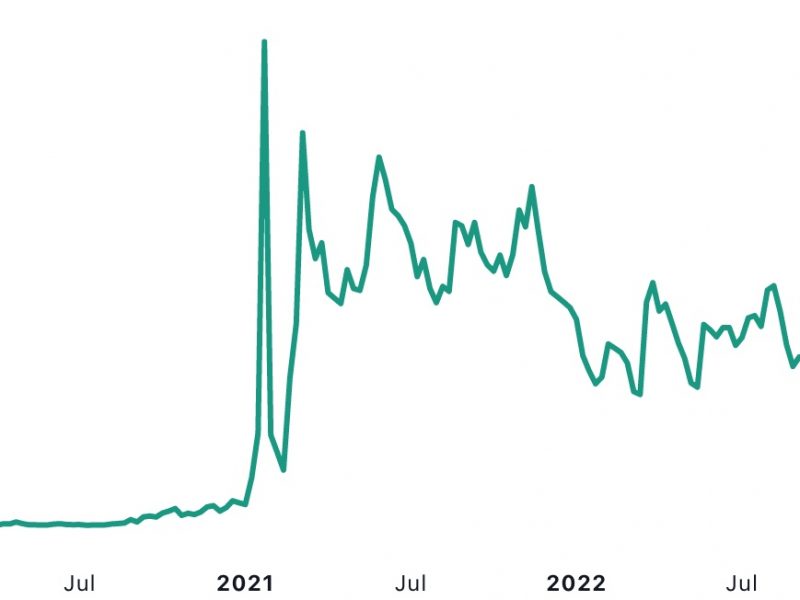

So that’s how we get to January 29, 2021. The day some of those contracts expire on the hedge funds and somehow, a whole lot of other nerds saw the same thing I did, felt the same thing I felt, and they’re buying the stock too. Because market is supply and demand, and if the hedge fund is demanding the stock, and the retail investors (aka regular people like me) hold the supply…well…one gets to name their price.

Or that’s how the market is supposed to work. But when the market is manipulated–when the poor investors are prohibited from buying more stock so that the rich hedge funds can sell to each other and lower the stock (also hoping to cause people to panic sell because they think the stock is tanking)–then it ignites a fire. People feel the unfairness of the market blatantly paraded during normal trading hours, and they will not tolerate it. Some fight for what’s right, some fight for profits, but whatever the cause, that leads us to this point in time, where hedge funds are selling in other areas to cover their losses, and blaming retail for the instability in the market. If they hadn’t been so greedy, the market would not be here. That’s the bottom line. Edit: Financial activism.